HRSA Loan Guarantee Program: Unlocking Financing for Health Centers

Community health centers provide quality primary care to over 29 million Americans, regardless of ability to pay. Over 1,400 health centers operate more than 12,000 service delivery sites nationwide, many of which are the only health care options available for low-income populations.

Continued financing for primary care — especially in rural and urban underinvested communities — is critical for both improving patient health outcomes and lowering health care costs. However, access to capital is often limited for health centers, as many traditional lenders are wary of financing health center projects.

The Health Resources and Services Administration’s (HRSA) Health Center Facility Loan Guarantee Program (LGP) offers a federal guarantee of up to 80 percent of a facility loan, minimizing risk to the lender and opening new financing avenues for health centers nationwide.

Nancy Lager, Senior Director of Capital Investment at PCDC, has served as the LGP Lender Coordinator for 9 years. She and Anne Dyjak, Managing Director of Capital Investment, recently talked about the program’s benefits, PCDC’s central involvement, and how to apply.

Nancy Lager [pictured]: The prospect of a HRSA loan guarantee may induce a lender to say “yes” when they might otherwise not have been willing to provide a loan. A lender’s reluctance may be due to volatility in a borrower’s finances, or because there’s a shortage of collateral for the specific loan request. The HRSA loan guarantee can help the health center gain access to capital which might have been unattainable before.

Nancy Lager [pictured]: The prospect of a HRSA loan guarantee may induce a lender to say “yes” when they might otherwise not have been willing to provide a loan. A lender’s reluctance may be due to volatility in a borrower’s finances, or because there’s a shortage of collateral for the specific loan request. The HRSA loan guarantee can help the health center gain access to capital which might have been unattainable before.

The LGP may also enable lenders to provide borrowers with more favorable loan terms, such as lowering interest rates or providing a fixed interest rate for a longer period.

Anne Dyjak: That’s exactly right. What the LGP really does is induce additional lenders to enter this space. There are untapped resources out there, and the LGP unlocks additional capital for the health centers who would most benefit from the assistance.

NL: PrairieStar, a health center in rural Kansas, wanted to construct a new facility that would double the size of their existing center, but needed to find a lender to fill a $3.3 million financing gap. They approached five local banks, but the high dollar amount on its face exceeded each bank’s capacity for an individual loan.

By leveraging a HRSA loan guarantee, PrairieStar was able to secure long-term financing from Prairie Bank of Kansas for the full amount they needed — with a more favorable interest rate, better loan term, and lower closing costs than the other banks had offered.

PrairieStar recently needed to expand again to meet the heightened demand created by the new center. This new expansion was financed by the same bank — this time without a loan guarantee. It’s a real success story.

NL: For the last 13 years, PCDC has worked with HRSA as the Lender Coordinator for the LGP. Our key responsibilities include responding to inquiries from lenders and borrowers, underwriting new loan guarantees, representing HRSA during loan closings, managing the portfolio of closed loans, and monitoring borrower performance during the term of the loan and guarantee. We also monitor and report to HRSA on what actions lenders are taking, update HRSA on borrowers’ plans and progress, and advise HRSA on lending issues.

AD [pictured]: I’d like to add that in this Lender Coordinator role, Nancy has developed a relationship with HRSA and she has been instrumental in sharing her experience and perspective as a lender.

AD [pictured]: I’d like to add that in this Lender Coordinator role, Nancy has developed a relationship with HRSA and she has been instrumental in sharing her experience and perspective as a lender.

HRSA is implementing changes to the LGP to streamline the process and make the program more accessible to lenders, and they have engaged Nancy as a thought partner during this process. As an organization that’s solely focused on health care, PCDC — and Nancy in particular — bring a deep expertise on health center lending.

NL: Health center lending is a pillar of our work, so that’s where we’ve really been able to provide the experience and understanding of what both lenders and borrowers are going through. That’s where PCDC’s strength lies and we believe that is why HRSA selected us.

AD: Beyond the Lender Coordinator role, PCDC has also been involved with the Lenders Coalition for Community Health Centers since its inception in 2013. The Lenders Coalition advocated for increased authority for HRSA and for revisions to the LGP to make it more accessible to lenders. In March 2018, Congress approved an increase of over $880 million of lending authority for HRSA under the LGP and HRSA has recently launched significant revisions to the LGP to make the program more accessible and improve the flow of capital to health centers.

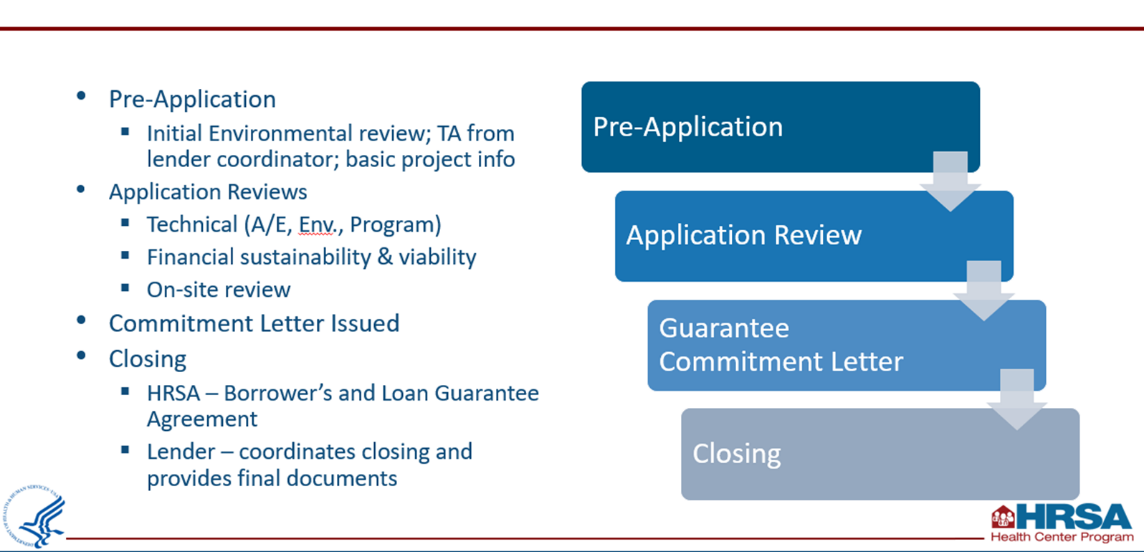

NL: HRSA has posted links to newly prepared materials including LGP Instructions and a sample application on the HRSA website, and HRSA will continue to add new materials as they become available. There is also a link where health centers and lenders can submit an email inquiry to the LGP staff and arrange for a conversation, if desired.. When the health center is ready to move forward, the pre-application process begins.

Health centers or lenders can always call us at PCDC to have informal discussions about eligibility. The inquiries we receive are wide-ranging and we are always happy to be responsive and helpful.

PCDC Awarded Contract for HRSA Health Center Facility Loan Guarantee Program

The Primary Care Development Corporation (PCDC) announced it has been re-designated as the Lender Coordinator for the Health Resources & Services Administration’s (HRSA) Health Center Facility Loan Guarantee Program, which can guarantee more than $880 million in new loans to health centers.